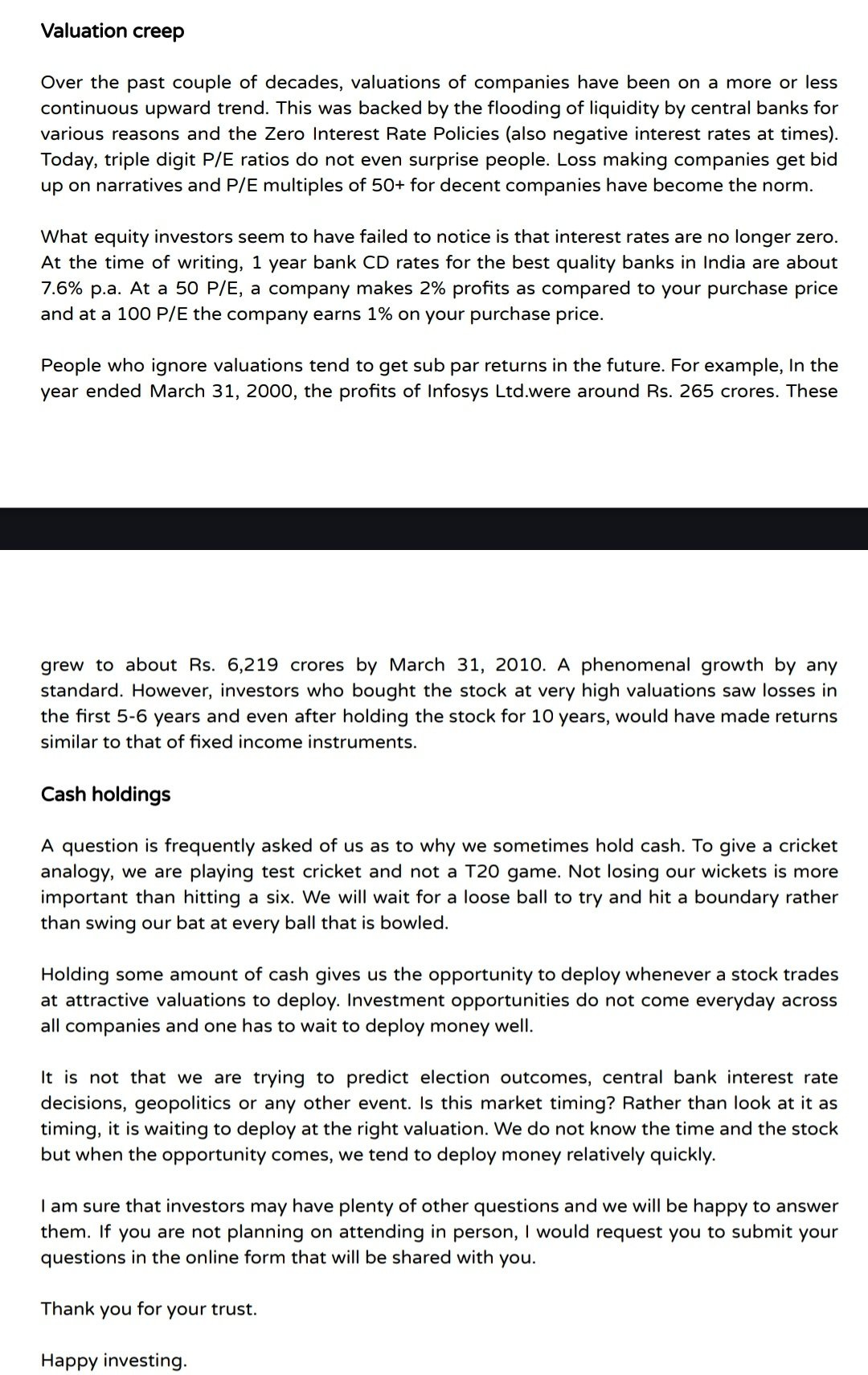

Rajeev Thakkar on Valuation and Cash holding (Read the full letter Here)

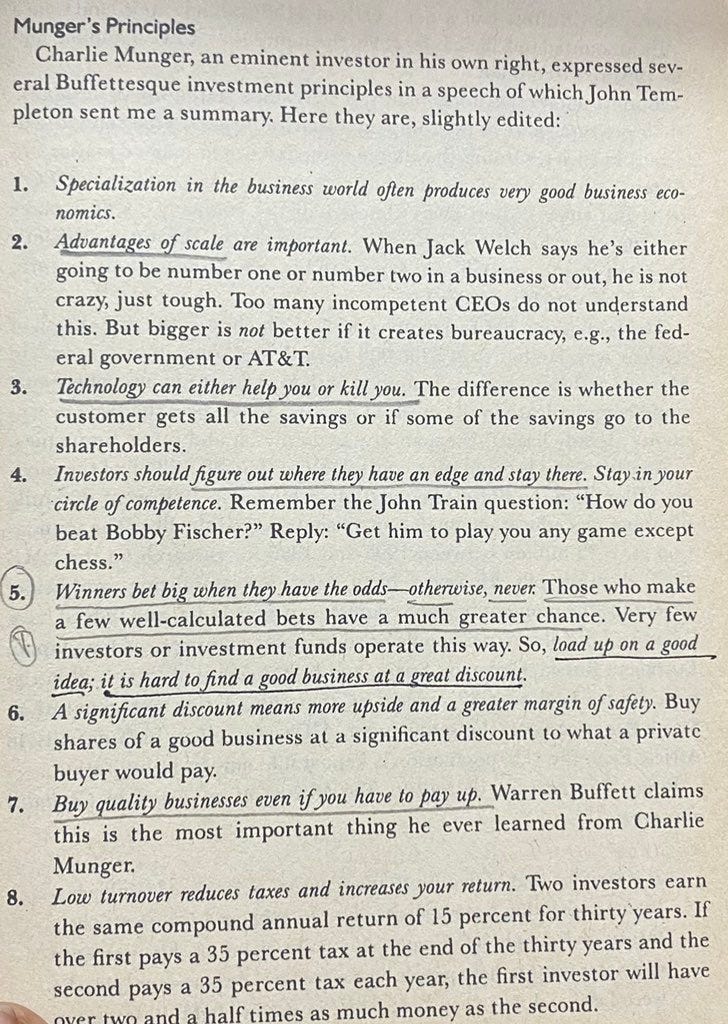

Charlie Munger's Principles (Book)

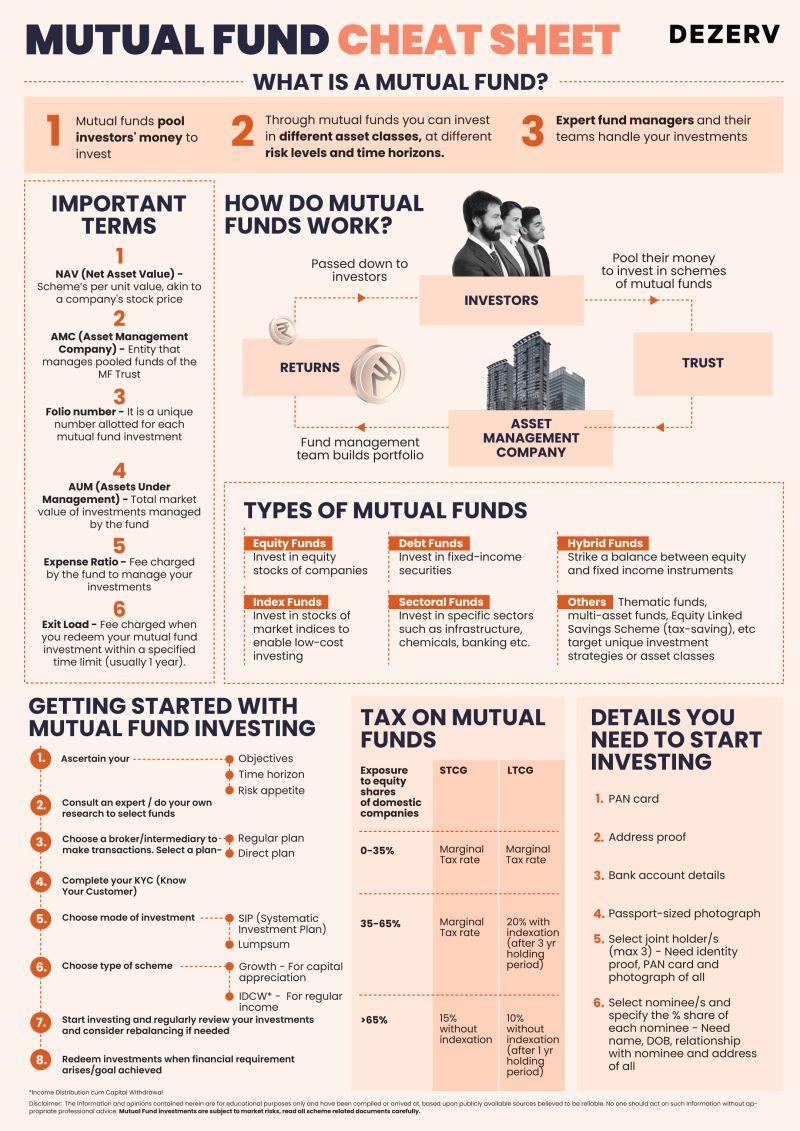

Mutual Fund Cheat Sheet (*Tax Rate Varies)

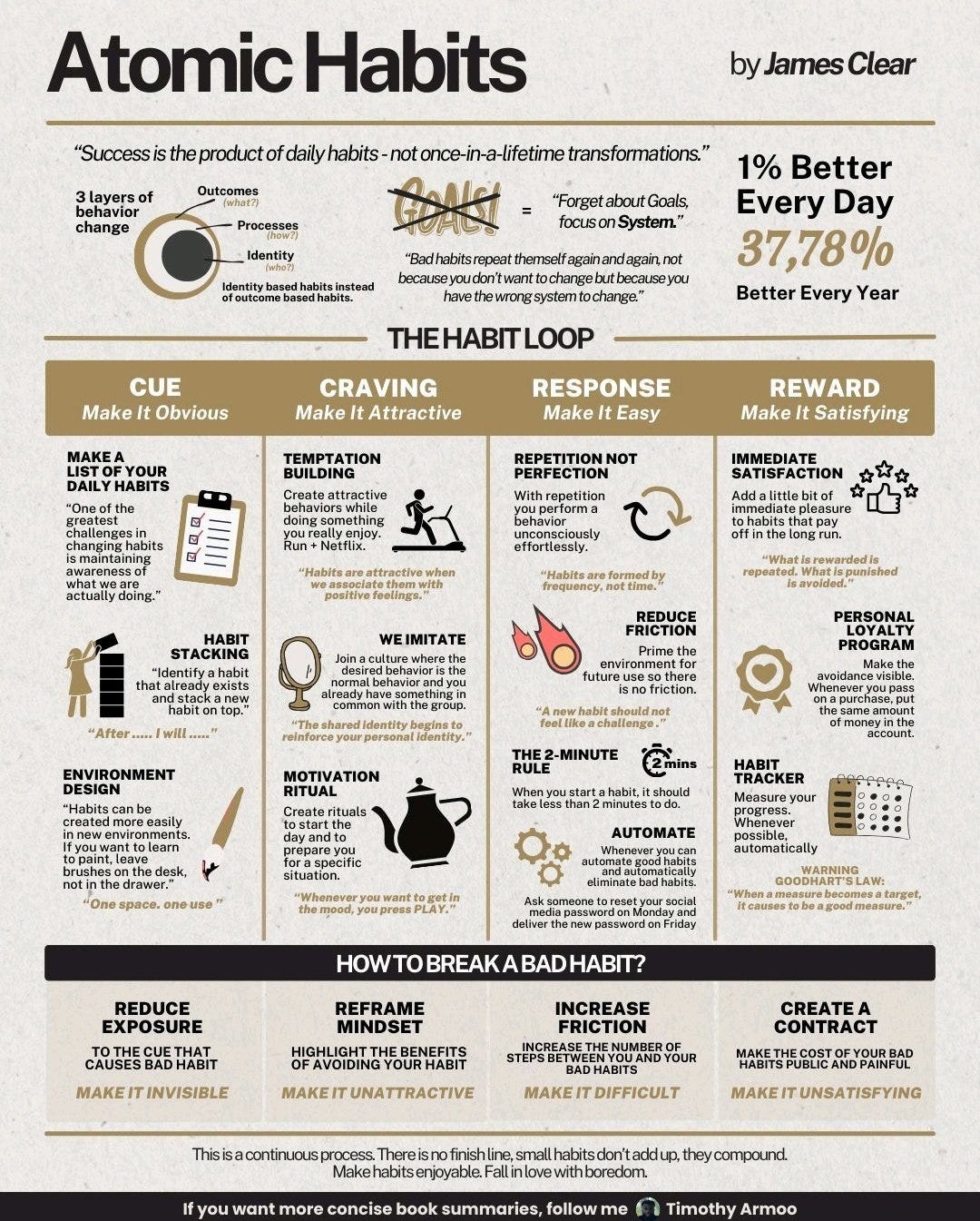

Small Habits, Big Results

Atomic Habits by James Clear

There are two requirements for success in wall street.

1. You have to think correctly and

2. You have to think independently

If I have noticed anything over 60 years on wall street, it is that people do not succeed in forecasting what's going to happen to the stock market

- Benjamin Graham (Source)

Interesting Books to read

Ratan Tata : A Life A comprehensive account of a life the likes of which the world has seldom seen

The Science of Rapid Skill Acquisition: Scientific Methods to accelerate your learning to save time, beat competition, and get from Point A to Point B at the speed of light

The Intelligent Investor: 75th Anniversary Special Edition

Buffett's Early Investments: Buffett’s Early Investments investigates ten investments that legendary investor Warren Buffett made in the 1950s and 1960s—earning him his first millions—and uncovers unique insights in the process

More and More and More: A radical new history of energy & humanity's insatiable need for resources that will change the way we talk about climate change

Love Investing and Tracking U.S. Stocks?

If so, you'll love the Compounding Quality newsletter!

Each week, they share valuable insights, tips, and much more — all for free.

Special Offer:

Exclusive 25% discount on the annual plan just for us!

Don't miss out on this opportunity to enhance your investing journey.

Thanks for reading.

Dhaval

If you enjoyed this, please share it with your friend.

Hello there,

Huge Respect for your work!

New here. No readers Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing poetic take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

Built to Be Left.

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e