Li Lu Compounded money 19.4% CAGR over 19 years (1998 To 2017). (6.5% for the S&P500 during the same period)

Let’s Learn How He does it.

Unlocking The Secrets Of Successful Value Investing

1. How to Analyze Companies

2. Investment Process, Criteria & Checklist

3. How to Identify Great Business

4. How to Research Sector/Industry

5. Circle Of Competence ⭕️

6. All about Management

7. Margin Of Safety

8. Biggest Risk In Investing

9. Investing Mistakes

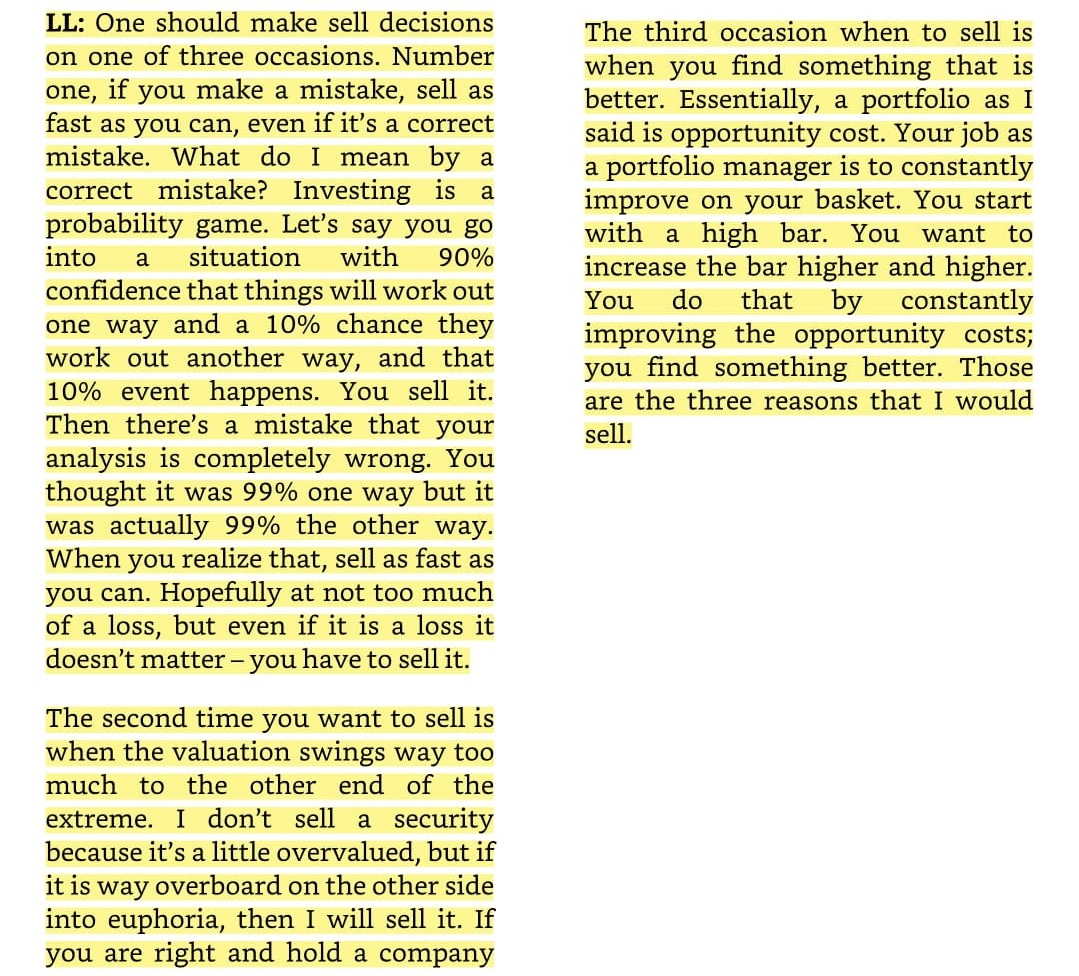

10. When to Sell

11. Life-Changing Learning From Warren Buffett

If you liked the investing insights shared above, I am sure you would love the book!

I have taken a lot of effort to curate this masterpiece. (Around 1.5 months of curation )

List Of Covered Topics:

Li Lu's Investing Process & Checklist

When to Buy, Hold and Sell

Value Investing Lessons

Investing Learning from Charlie Munger and Warren Buffett

Value Investing In China

Insights on China from an Investor’s POV

Li Lu's Personal Life

How to research a business, How to Build Conviction & How not to Overpay

Knowing the importance of the Circle Of Competence

Learnings from 3 of the biggest financial crisis

Important Things to Investing

Traits Of a Value Investor

To sum it up, It contains everything you need to know about Li-Lu (Both his Personal & Professional Life)

You can Buy the Book by clicking on the below Links.

Indian Customer - Click Here

Outside India - Click Here

(Pls, do note that I am only charging for the hard work I have put into curating this Masterpiece. I am not charging for the content as it is already available in the public domain.)

That’s it from my end for this week. Thanks for reading.

See you again next week!

Dhaval.

If you enjoyed this, please share it with your friend.